Two Types of People

There are 2 types of people in this world: those who are willing to take risks, and those who are not but do it anyway. No one is free from risk. No One.

The COVID-19 pandemic taught all of us lessons about risk. I certainly didn’t imagine such a thing would happen, and that it would touch nearly every human on this planet. But it did. And some people have been positively impacted. Others have had their livelihoods stripped from them. Others are dead.

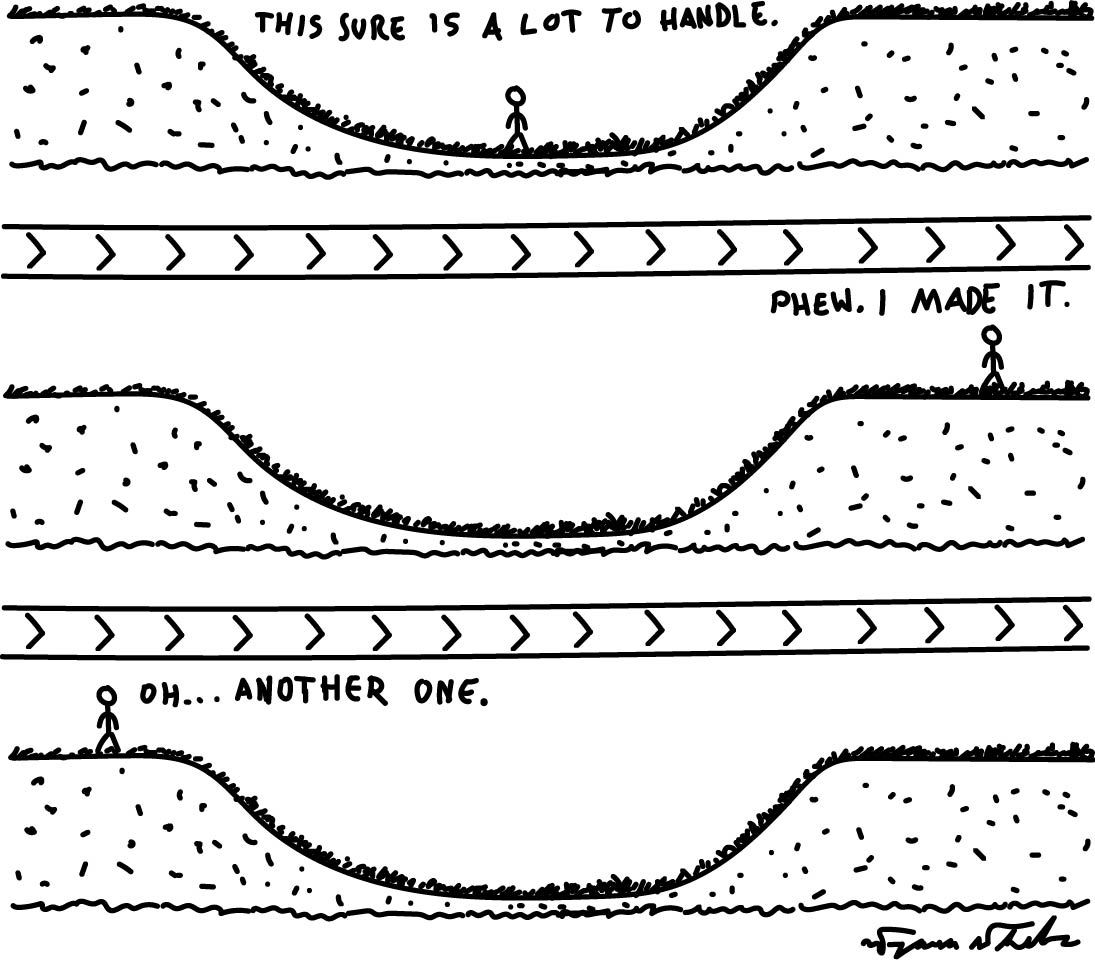

The primary effects (infections, death, and shutdowns) of this pandemic are behind us, but the lingering, secondary effects will never be truly known or understood. What is understood is there will always be threats to your values. A close friend of mine says he often feels like he’s in one of three places: enduring a valley, just coming out of a valley, or getting ready to go through the valley. His point is there's always a valley. And rarely do we traverse the same valley twice.

The expectation of disruption in our lives could actually be empowering. If we acknowledge our lives will be disrupted (often painfully so) then we no longer have to live in this fear of “what if?”. We know we’ll eventually be the victim. It’s just a matter of when and on what scale.

If we come to believe that bad things will inevitably happen to us and then stop there, it will sink us into desperation and depression. But if we combine the expectation with thoughtful preparation, suddenly we are ready for anything. So, how do we prepare?

First, acknowledge EVERY choice has risk, and risk has two sides: The odds I’ll get hurt and the extent of the damage if I do.

Next, get real about the odds of getting hurt. For example, there’s certainly risk in putting money into the stock market, but the odds of all the stocks in the United States going to zero is very small. It’s never happened in the USA, but it has happened to other countries.

Finally, frequently consider the worst case scenarios of your choices. What’s the worst that could happen if you choose to invest your retirement assets completely in the stock market? Stock values can sink, some even go to zero. Where would that leave you? Back to work? Dependent on the government for sustenance (if the government still remains)? How would that make you feel?

“There’s no way I could live like that” you say. Okay, so what are your alternatives? Keep your money in the bank? Produce your own food? Now you have to consider a whole new set of worst-case scenarios. Some risks are more bearable than others, but only you know what your preferences truly are.

The only failure on your part is if you don’t take the time to seriously consider those risks. The opposite of wisdom in your choices isn’t stupidity….at least we’ll learn pretty quickly from dumb choices. No, the most dangerous state of our families would be apathy. Kick risk apathy out of your homes, it’s not welcome there.

Psalm 23:4