Meet the Gotrocks

If I were asked to form a Mount Rushmore of investing, I’d include Benjamin Graham, Warren Buffett, Daniel Kahneman, and Jack Bogle. If you ever search for investing inspiration, read the writings by or about any of these men, and you will likely discover something profound.

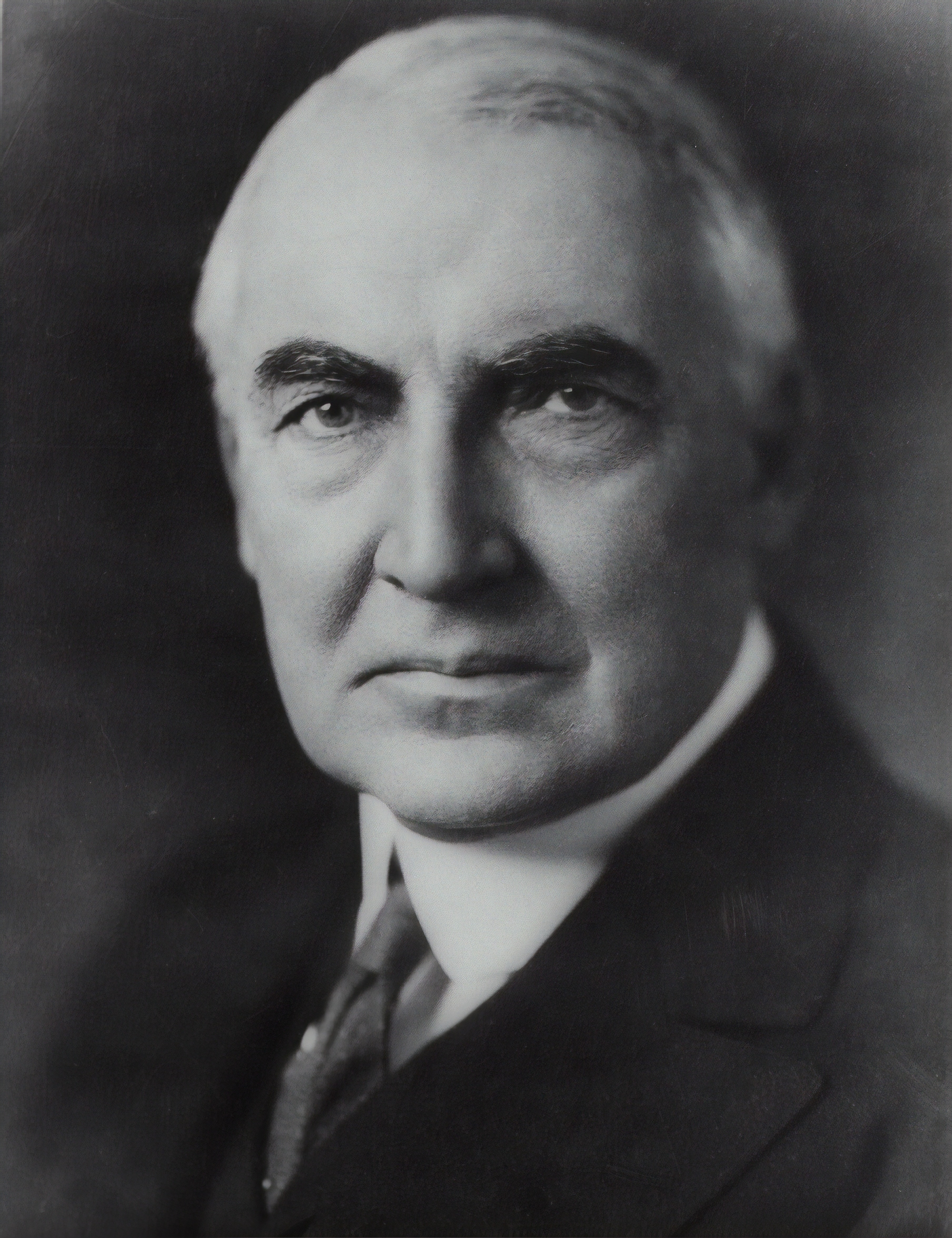

One such writing was by Mr. Buffett (known as the “Oracle of Omaha”) in his 2005 shareholder letter to Berkshire Hathaway stockholders. His annual stockholder letter typically contains some simple, yet profound insights. In his 2005 letter, he used an allegory to make a point about successful investing. I use it as a bedrock of my own investment philosophy for Greater Than Financial.

The story is about a family, the Gotrocks, who own all of the United States stock market. This means they are the owners of all of the companies in the US, both bad and good, and are entitled to all the dividends and gains in value in those companies. 100% of the productivity and resulting gains of those companies belong to the extended Gotrock family.

The US is very productive, so it’s a prosperous scenario, until “the Helpers” arrive on the scene.

The Helpers go to work convincing some of the Gotrocks family members, let's call them the “cousins”, they can increase their particular share of the gains compared to other family members. All they have to do is buy some particular US companies the Helpers advise are “good bets” while selling the companies the Helpers think are laggards to others in the family.

These Gotrocks cousins are already experiencing the prosperity of owning all US companies in equal amounts with the rest of the Gotrocks family, but the prospects of gaining a bigger share of the pie is too tempting. So they take the Helpers' advice and buy more of some companies, and sell parts of other companies, of course paying a substantial fee to the Helpers for their advice.

Now here’s the dilemma: all of these US companies are going to continue to produce the same amount of gains and dividends no matter who holds what share of ownership in each company. So the overall size of the pie stays the same for the Gotrocks family. Except now, the Helpers have come in and taken their own slice of the pie, via their advice fee, by appealing to certain family members. The Helpers are better off, but the Gotrocks are worse off.

In this story, your family is the Gotrocks, and the financial advice industry are the Helpers. Your family, by subjecting your investments to the fees of the Helpers, is likely lowering the productivity (aka the returns) of your family’s assets. Also, research tells us the investments of those who take and pay for the advice of the Helpers typically end up performing worse than those who buy and hold the entire market.

Moral of the story: beware the Helpers. Know who you are paying and what you are paying for financial advice.